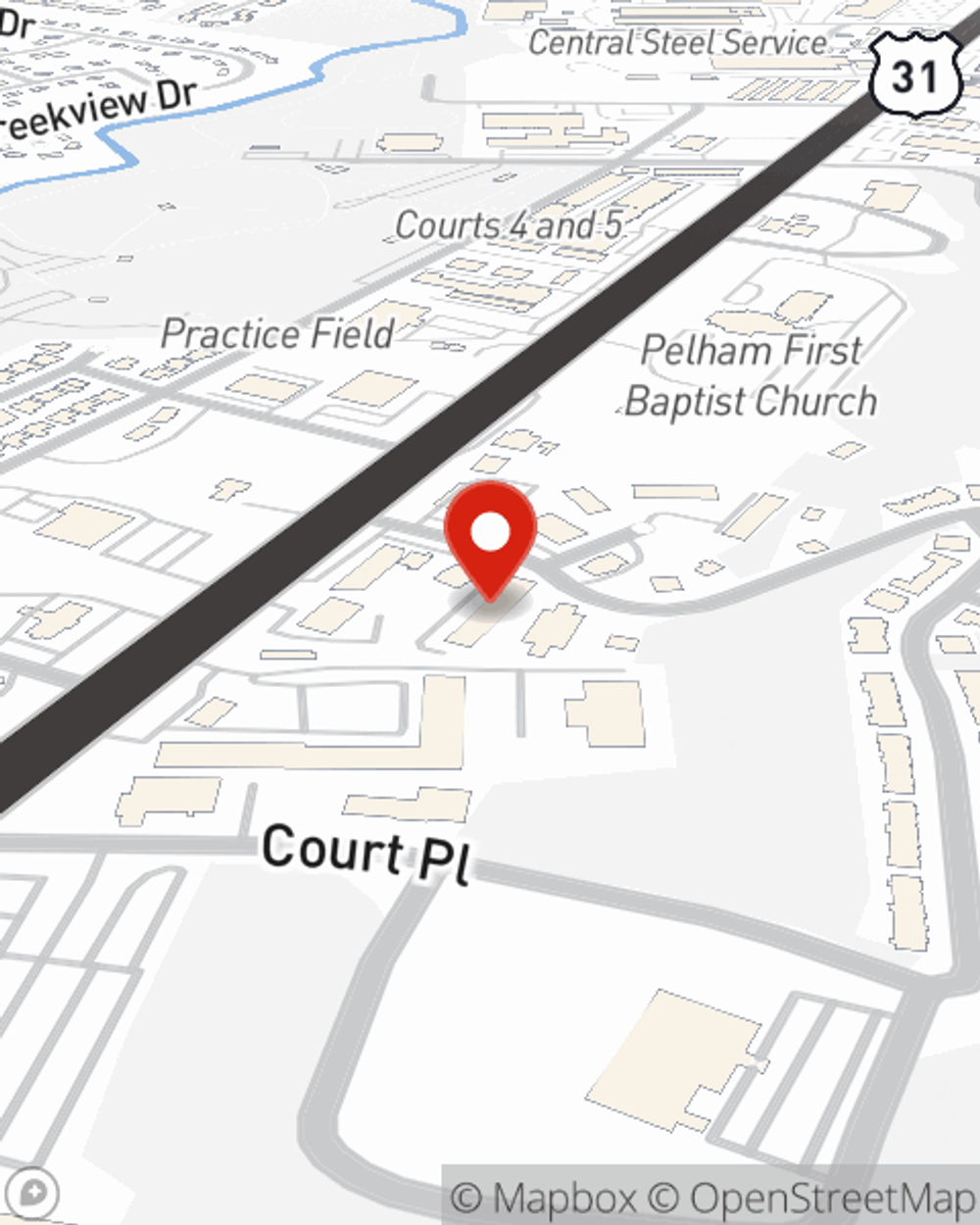

Business Insurance in and around Pelham

One of the top small business insurance companies in Pelham, and beyond.

Cover all the bases for your small business

- Pelham, AL

- Helena, AL

- Alabaster, AL

- Hoover, AL

- Birmingham, AL

- Riverchase, AL

- Indian Springs, AL

- Calera, AL

- Chelsea, AL

- Vestavia, AL

- Homewood, AL

- Mountain Brook, AL

- McCalla, AL

- Bessemer, AL

- Gardendale, AL

- Clanton, AL

- Jemison, AL

- Montevallo, AL

- Trussville, AL

- Irondale, AL

- Tuscaloosa, AL

- Huntsville, AL

- Madison, AL

- Montgomery, AL

Help Prepare Your Business For The Unexpected.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all alone. State Farm agent Joseph Chambers, a fellow business owner, is aware of the responsibility on your shoulders and is here to help you put together a policy that's right for your needs.

One of the top small business insurance companies in Pelham, and beyond.

Cover all the bases for your small business

Keep Your Business Secure

For your small business, whether it's an advertising agency, a vet hospital, a photography business, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like loss of income, equipment breakdown, and business property.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Visit State Farm agent Joseph Chambers's team today with any questions you may have.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Joseph Chambers

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.